La secrétaire d'Etat américaine, Hillary Clinton, a solennellement annoncé dimanche que Washington « appuyait fortement les appels » à une enquête indépendante sur le meurtre barbare du chef d'Etat libyen évincé, Mouammar Kadhadi.

Sur quoi exactement Mme Clinton veut-elle enquêter qu'elle ne connaît pas déjà ?

Kadhafi a été capture jeudi alors qu'il fuyait sa ville natale de Syrte. Au cours du mois précédent, Syrte avait subi un bombardement continu de l'OTAN et un siège brutal des soi-disant « rebelles » qui ont détruit la ville en causant la mort d'un nombre incalculable de civils et de blessés.

Son convoi, détecté par des avions espions américains, fut d'abord attaqué par un drone Predator américain qui était téléguidé depuis une base aérienne au Nevada. Un avion de surveillance américain AWAC a ensuite fait appel à des avions de combat français qui ont largué deux bombes de 500 livres sur les véhicules dans lesquels se trouvaient le colonel Kadhafi et son entourage.

Les frappes aériennes ont laissé des dizaines de morts et le dirigeant libyen blessé. Il fut ensuite pourchassé par les « rebelles » soutenus par l'OTAN qui agissaient en accord avec des « conseillers » des forces des unités spéciales britanniques SAS.

Les derniers moments de Kadhafi ont été enregistrés par un nombre de séquences vidéo agitées et filmées avec les téléphones portables de ses assaillants. Elles montrent un Kadhafi blessé hurlant et résistant faiblement à une horde de miliciens frénétiques qui sont en train de le provoquer et de l'attaquer alors qu'il crie « Allahou Akbar » - « Dieu est grand ». Il est traîné, frappé à coups de pied et battu jusqu'au sang à coups de fusils et de poings avant d'être jeté sur le capot d'un véhicule. Une séquence montre un pistolet près de sa tête puis son corps sur le trottoir alors que du sang coule de l'arrière de son crâne.

Comme l'a dit laconiquement l'un des membres du Conseil national de transition (CNT) soutenu par l'OTAN basé à Benghazi, « Ils l'ont battu très durement puis ils l'ont tué. »

A la question posée à Clinton par Christiane Amanpour de la chaîne américaine ABC quant à sa « réaction première » aux horribles séquences vidéo des téléphones portables, Clinton a répondu, « Eh bien Christiane, vous savez, personne ne veut bien évidemment voir un être humain dans cet état. »

Les déclarations de Clinton avaient manifestement été bien préparées et visaient à apaiser le dégoût provoqué dans le monde par les vues du lynchage de Kadhafi. Quant à sa « réaction première », elle avait été révélée le jour de l'assassinat même, lorsqu'elle avait ri en disant à un journaliste, « Nous sommes venus, nous avons vu, il est mort. »

En effet, 48 heures à peine avant le lynchage de Kadhafi, la secrétaire d'Etat américaine s'était envolée pour Tripoli où elle avait déclaré que le dirigeant libyen devait être « capturé mort ou vif, » dès que possible.

Il s'agissait difficilement d'une boutade. La guerre Etats-Unis/OTAN contre la Libye qui a duré huit mois a été menée dans le but d'un « changement de régime » pour renverser Kadhafi et mettre en place un régime marionnette qui répondra plus docilement aux attentes de Washington et de ses alliés de l'OTAN, ainsi que des grands conglomérats énergétiques occidentaux.

En utilisant comme couverture les soulèvements populaires survenus en Tunisie et dans l'Egypte avoisinantes, les Etats-Unis et leurs alliés ont délibérément fomenté en Libye une confrontation armée pour ensuite chercher à rassembler un soutien pour s'assurer de l'approbation de l'ONU pour une intervention sous le faux prétexte de protéger la vie des civils.

Sous cette bannière « humanitaire », ils ont mené une guerre aérienne incessante et criminelle contre ce pays d'Afrique du Nord riche en pétrole tout en effectuant sans cesse des tirs de missiles et des bombardements qui ciblaient Kadhafi et sa famille. Le 1er mai, une frappe aérienne de missiles de l'OTAN sur la résidence de Kadhafi à Tripoli avait tué l'un de ses fils et trois de ses petits-enfants. Tous les moyens techniques des Etats-Unis et de l'OTAN avaient été mis en oeuvre en Libye dans le but de localiser le dirigeant libyen pour le tuer.

Ce n'était pas non plus la première tentative du genre. En 1969 déjà, comme le révèle Henry Kissinger dans ses mémoires, des discussions avaient eu lieu au sein du gouvernement américain au sujet d'une action secrète pour assassiner Kadhafi, en raison surtout de son nationalisme radical, son ingérence dans le contrôle américano-saoudien de la politique pétrolière de l'OPEP (Organisation des pays exportateurs de pétrole) et de sa fermeture de la plus grande base aérienne du Pentagone sur le continent africain. En 1986, le gouvernement Reagan avait exécuté le bombardement de la résidence-caserne de Kadhafi à Tripoli. Et, dans les années 1990, les services secrets britanniques MI6 avaient comploté avec des éléments islamistes en vue de le tuer.

Alors qu'après la dissolution de l'Union soviétique Kadhafi avait cherché à s'arranger avec l'Occident en renonçant aux « armes de destruction massive » et en collaborant activement à la « guerre mondiale contre le terrorisme » des Etats-Unis, les puissances impérialistes n'ont ni pardonné ni oublié ses infractions d'antan.

Quant à Hillary Clinton et au gouvernement Obama, le fait d'appeler à une enquête sur le meurtre de Kadhafi est de loin plus que du cynisme. C'est comme si le gouvernement Eisenhower avait exigé une enquête sur l'assassinat de Patrice Lumumba, ou si la Maison Blanche de Nixon avait demandé une enquête internationale sur la mort de Salvador Allende.

La principale différence est qu'à l'époque c'était la CIA qui était connue comme « Murder Inc. » (Cie des assassinats) pour ses opérations secrètes. A présent, le gouvernement américain dans son ensemble préconise ouvertement et sans complexe l'assassinat comme un outil principal de la politique étrangère.

A trois reprises, en moins de six mois, le président Obama était venu parader devant les caméras de télévision pour annoncer des exécutions illégales. En mai dernier, il s'agissait de la liquidation d'Oussama ben Laden qui, non armé, fut tué par balle par des forces spéciales américaines. En septembre, eut lieu l'assassinat au Yémen par un missile hellfire d'un citoyen américain, Anwar-al-Awlaki. Un deuxième citoyen américain, Samir Khan, fut tué au cours d'une attaque. Et maintenant, Obama revendique le mérite du lynchage de Kadhafi.

D'innombrables autres personnes ont été assassinées de la même manière avec moins de tapage au Pakistan, au Yémen, en Somalie et ailleurs. Deux semaines après le meurtre d'Awlaki, un missile hellfire a coûté la vie à son fils, Abdulrahman âgé de 16 ans, et qui, tout comme son père, était un citoyen américain né aux Etats-Unis. Cette attaque, qui a tué huit autres personnes, la plupart d'entre eux des mineurs, n'a pratiquement pas été signalée dans les médias américains.

Au lieu de cela, les magnats de la presse discutent pour savoir si ces « succès de la politique étrangère » contribueront à faire réélire le président, avec Obama se présentant vraisemblablement aux élections avec son score record d'« assassin en chef » qui approuve les « kill lists »(listes de personnes à tuer) établies par le comité secret qui est effectivement devenu un nouveau service extraconstitutionnel du gouvernement américain.

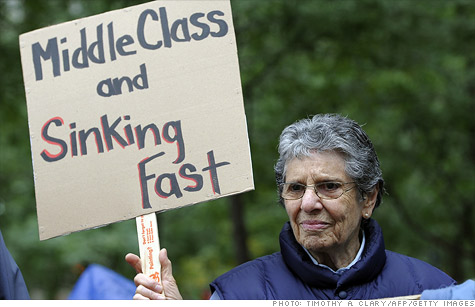

Le meurtre sauvage de Mouammar Kadhafi est emblématique d'une politique illégale et violente de la part de l'élite dirigeante américaine qui cherche désespérément à compenser le déclin économique du capitalisme américain par une série sans fin de guerres et de provocations destinées à prendre le contrôle des ressources vitales et des marchés.

Obama et Hillary Clinton croient, à juste titre, qu'ils n'ont rien à craindre d'une enquête des Nations unies ou de la Cour pénale internationale sur le meurtre de Kadhafi. Néanmoins, la tentative irresponsable de réimposer le colonialisme au Moyen-Orient et en Afrique du Nord ne résoudra pas mais, au contraire, ne fera qu'exacerber les insolubles contradictions économiques et sociales et la crise du capitalisme américain et mondial.

La crise entraînera la classe ouvrière dans une lutte internationale en créant les conditions d'un règlement de compte révolutionnaire avec les crimes de l'impérialisme américain.

palestine-solidarite.org

Située à la frontière entre le Sénégal et la Mauritanie, Rosso-Sénégal connaît une intense activité économique propice au développement de l’informel. Mais aussi de la contrebande, du trafic de devises du fait de sa position de ville-carrefour.

Située à la frontière entre le Sénégal et la Mauritanie, Rosso-Sénégal connaît une intense activité économique propice au développement de l’informel. Mais aussi de la contrebande, du trafic de devises du fait de sa position de ville-carrefour.